In the initial hours and days of a Trump victory, the path forward for taxes begins to clarify. Much of this resembles principles that Ronald Reagan promoted in the lead-up to his 1986 overhaul of the tax code, mainly centering around simplification, elimination of preferences and overall fairness (most of which was abandoned first by Bush I and then Clinton, Bush II, and Obama in succession).

The following is an excerpt taken directly from a November 10 Wall Street Journal article by Laura Sanders and does a marvelous job of laying out the plans as they currently sit. As an aside, I believe every person in business, whether that business is large or small, should subscribe to the Wall Street Journal. Their insight is invaluable when planning for the future.

Income-tax rates:

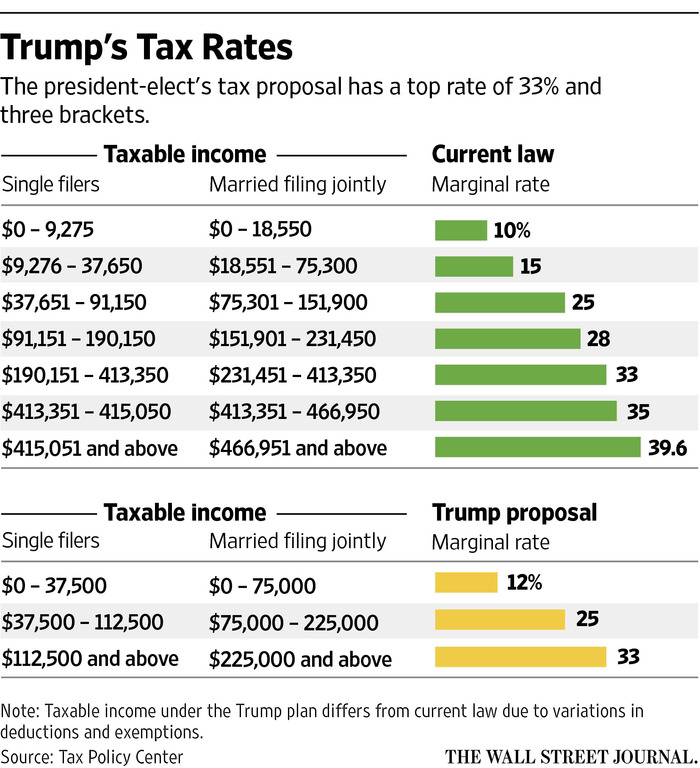

Both Messrs. (President-Elect) Trump’s and (Speaker Paul) Ryan’s plans would consolidate the current rates on “ordinary” income such as wages and interest from seven brackets to just three—12%, 25% and 33%. It would also make changes to the calculation of “taxable income.”

The top rate of 33% would take effect at about $225,000 of taxable income for married couples; currently the top rate of 39.6% kicks in at $467,000 for couples. The top rate for singles under Mr. Trump’s plan would take effect at about $113,000, compared with $415,000 now, according to the Tax Policy Center in Washington.

In 2016 the 33% rate takes effect at about $231,000 of taxable income for married couples and $190,000 for singles.

Mr. (House Ways and Means Chairman Dave) Camp’s plan would also have three rates, with a top one set at 35%.

The upshot is that while most people would have lower tax bills, higher earners would save much more. According to the Tax Policy Center, nearly half the benefits from the Trump plan would go to the top 1% of households—those earning more than about $700,000. It could also increase taxes on many single parents and two-parent families with more than two children, although the Trump campaign said it would make sure this didn’t happen.

Deductions and credits:

All three plans would make it harder for individuals to benefit from specific tax deductions, for several reasons. One is that each plan raises the amount of the “standard” deduction, which gives taxpayers less need to break out deductions for mortgage interest, charitable gifts, state taxes and the like on Schedule A.

In addition, the value of a deduction drops as a taxpayer’s rate goes down. Thus higher earners may want to make charitable gifts this year to reap a greater benefit.

Each of the three plans also imposes other limits on deductions. For example, Mr. Trump’s plan would cap the value of Schedule A deductions at $100,000 for singles and $200,000 for married couples. Mr. Ryan’s plan would eliminate all deductions other than those for mortgage interest and charitable gifts. The Camp plan limits mortgage interest and would only allow charitable deductions above 2% of income.

The Trump plan is notable in offering a child-care tax benefit, even if the parents don’t pay for child care.

The following is an excerpt taken directly from a November 10 Wall Street Journal article by Laura Sanders and does a marvelous job of laying out the plans as they currently sit. As an aside, I believe every person in business, whether that business is large or small, should subscribe to the Wall Street Journal. Their insight is invaluable when planning for the future.

Income-tax rates:

Both Messrs. (President-Elect) Trump’s and (Speaker Paul) Ryan’s plans would consolidate the current rates on “ordinary” income such as wages and interest from seven brackets to just three—12%, 25% and 33%. It would also make changes to the calculation of “taxable income.”

The top rate of 33% would take effect at about $225,000 of taxable income for married couples; currently the top rate of 39.6% kicks in at $467,000 for couples. The top rate for singles under Mr. Trump’s plan would take effect at about $113,000, compared with $415,000 now, according to the Tax Policy Center in Washington.

In 2016 the 33% rate takes effect at about $231,000 of taxable income for married couples and $190,000 for singles.

Mr. (House Ways and Means Chairman Dave) Camp’s plan would also have three rates, with a top one set at 35%.

The upshot is that while most people would have lower tax bills, higher earners would save much more. According to the Tax Policy Center, nearly half the benefits from the Trump plan would go to the top 1% of households—those earning more than about $700,000. It could also increase taxes on many single parents and two-parent families with more than two children, although the Trump campaign said it would make sure this didn’t happen.

Deductions and credits:

All three plans would make it harder for individuals to benefit from specific tax deductions, for several reasons. One is that each plan raises the amount of the “standard” deduction, which gives taxpayers less need to break out deductions for mortgage interest, charitable gifts, state taxes and the like on Schedule A.

In addition, the value of a deduction drops as a taxpayer’s rate goes down. Thus higher earners may want to make charitable gifts this year to reap a greater benefit.

Each of the three plans also imposes other limits on deductions. For example, Mr. Trump’s plan would cap the value of Schedule A deductions at $100,000 for singles and $200,000 for married couples. Mr. Ryan’s plan would eliminate all deductions other than those for mortgage interest and charitable gifts. The Camp plan limits mortgage interest and would only allow charitable deductions above 2% of income.

The Trump plan is notable in offering a child-care tax benefit, even if the parents don’t pay for child care.

Capital gains and qualified dividends:

Mr. Trump’s plan would leave the current rate structure of 0%, 15% and 20% in place.

Mr. Ryan’s plan would revert to an older code provision that taxes capital gains, dividends and interest as ordinary income—after excluding 50% of it. Thus lower earners would see their rate rise from 0% to 6%, those in the middle would owe 12.5%, and the rate for top earners would fall to 16.5% from top 20%.

The Camp plan takes a similar approach but gives a 40% exclusion for capital gains and dividends, for a top rate of 21%.

Both the Trump and Ryan plans would eliminate a 3.8% surtax on net investment income. The Camp plan would retain the surtax but in some cases reduce it to 2.28%.

Alternative minimum tax:

All three plans would eliminate the alternative minimum tax, a levy that rescinds tax breaks and the benefit of lower brackets for people it applies to.

Estate and gift taxes:

Mr. Ryan’s plan would eliminate all gift and estate taxes. Mr. Trump’s plan would also eliminate these levies, but it would impose income taxes on the capital gains of assets held at death—beyond an exemption of about $5 million per person or $10 million per couple.

The Camp plan has no proposal on gift and estate taxes.

Revenue effects:

These sweeping changes don’t come cheap. The changes to individuals’ taxes in Mr. Trump’s plan would reduce federal revenue by an estimated $3.5 trillion over 10 years, while Mr. Ryan’s plan reduced it by an estimated $2.2 trillion. Mr. Camp’s plan doesn’t raise or lower much revenue over 10 years, but reductions after 10 years could be significant. These figures don’t take into account changes in the economy that could raise or lower tax revenue.

Corrections & Amplifications:

Under the Trump and Ryan tax proposals, the top rate of 33% would take effect at about $225,000 of taxable income for married couples; currently the top rate of 39.6% kicks in at $467,000 for couples. An earlier version of this article said that currently “that” rate kicks in at $467,000 for couples, without specifying it was referring to the current top rate of 39.6%, not the 33% rate.

The top rate for singles under Mr. Trump’s plan would take effect at about $113,000, compared with $415,000 now, according to the Tax Policy Center in Washington. An earlier version of this article incorrectly said the top rate for singles would take effect at about $186,000. (Nov. 10)

Write to Laura Saunders at [email protected]

Also, feel free to contact me at [email protected]

Mr. Trump’s plan would leave the current rate structure of 0%, 15% and 20% in place.

Mr. Ryan’s plan would revert to an older code provision that taxes capital gains, dividends and interest as ordinary income—after excluding 50% of it. Thus lower earners would see their rate rise from 0% to 6%, those in the middle would owe 12.5%, and the rate for top earners would fall to 16.5% from top 20%.

The Camp plan takes a similar approach but gives a 40% exclusion for capital gains and dividends, for a top rate of 21%.

Both the Trump and Ryan plans would eliminate a 3.8% surtax on net investment income. The Camp plan would retain the surtax but in some cases reduce it to 2.28%.

Alternative minimum tax:

All three plans would eliminate the alternative minimum tax, a levy that rescinds tax breaks and the benefit of lower brackets for people it applies to.

Estate and gift taxes:

Mr. Ryan’s plan would eliminate all gift and estate taxes. Mr. Trump’s plan would also eliminate these levies, but it would impose income taxes on the capital gains of assets held at death—beyond an exemption of about $5 million per person or $10 million per couple.

The Camp plan has no proposal on gift and estate taxes.

Revenue effects:

These sweeping changes don’t come cheap. The changes to individuals’ taxes in Mr. Trump’s plan would reduce federal revenue by an estimated $3.5 trillion over 10 years, while Mr. Ryan’s plan reduced it by an estimated $2.2 trillion. Mr. Camp’s plan doesn’t raise or lower much revenue over 10 years, but reductions after 10 years could be significant. These figures don’t take into account changes in the economy that could raise or lower tax revenue.

Corrections & Amplifications:

Under the Trump and Ryan tax proposals, the top rate of 33% would take effect at about $225,000 of taxable income for married couples; currently the top rate of 39.6% kicks in at $467,000 for couples. An earlier version of this article said that currently “that” rate kicks in at $467,000 for couples, without specifying it was referring to the current top rate of 39.6%, not the 33% rate.

The top rate for singles under Mr. Trump’s plan would take effect at about $113,000, compared with $415,000 now, according to the Tax Policy Center in Washington. An earlier version of this article incorrectly said the top rate for singles would take effect at about $186,000. (Nov. 10)

Write to Laura Saunders at [email protected]

Also, feel free to contact me at [email protected]

RSS Feed

RSS Feed